The IRS tax processes have often been a complex issue for US citizens. There are many details to pay attention to, such as laws and ever-changing rates. If we want to benefit from tax deductions, we need to master all these. However, it is kind of impossible. Fortunately, tax attorneys make all these procedures stress-free. A reputable tax relief company can offer guidance on how to deal with IRS rules in a way that works for you.

In this article, we will review the best tax relief companies in California, specifically in Los Angeles, San Diego, San Jose, San Francisco, Sacramento, and Long Beach.

Tax relief companies in California

Precision Tax Relief – Stateside

Since 1967, Precision Tax Relief has been helping individuals and businesses pay their IRS tax debts. The company is known for high customer satisfaction. Besides, unlike other company rules, customers don’t need to have a minimum debt amount. One of the best parts is that you can easily reach the company via phone, text message, e-mail, and live chat.

Services offered: Specializes in IRS tax settlements (Offers in Compromise), back tax returns, assistance with revenue officers, payroll tax problems, wage garnishments, bank levies, tax liens, IRS payment plans, penalty relief, and current year tax preparation.

Experience: Operating since 1967, with a team comprising IRS Enrolled Agents, CPAs, and an attorney, averaging 20 years of experience.

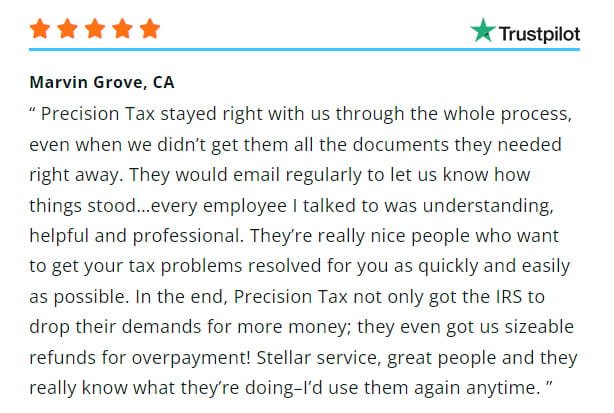

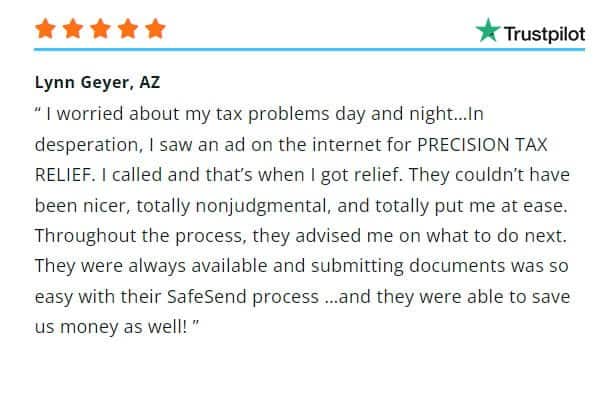

Customer satisfaction: Holds a 98% satisfaction rating across over 600 reviews, with clients praising their professionalism, transparency, and effectiveness in resolving tax issues.

Pricing: Utilizes a transparent, flat-fee structure with flexible payment plans and offers a 30-day money-back guarantee.

Pros

- Free initial consultation

- High customer satisfaction with a 98% rating

- Accredited by the American Society of Tax Problem Solvers (ASTPS)

- Offers a 30-day money-back guarantee

- One flat fee with flexible payment options

- It is suitable if you owe more than $10.000

Precision Tax Relief is known for its great help with IRS problems. This helps clients feel less stressed and have less money to worry about. The company has successfully settled many debts for a fraction of the original amount. Clients praise the staff for their kindness, expertise, and hard work. They say they can explain complicated tax matters clearly and work quickly to solve them. Several testimonials express gratitude and high recommendations for Precision Tax Relief services and demonstrate the company’s commitment to client success and its proficiency in navigating tax regulations.

HillHurst Tax Group – California

HillHurst Tax Group helps people and corporations in Los Angeles with their tax issues by giving them personalized approaches. They offer local expertise and a high success rate at solving tax problems.

Services offered: Helps with back taxes, removing tax liens, stopping wage garnishments and bank levies, audit support, and tax preparation. Also handles payroll tax issues and helps with IRS programs like Offer in Compromise.

Experience: Over 30 years of combined experience with a team of licensed tax experts who work directly with the IRS and state tax agencies.

Customer satisfaction: Known for professionalism and clear communication. Clients appreciate their ability to solve tax problems quickly and effectively.

Pricing: Offers clear pricing with no hidden fees. Initial reviews are often free, and payment plans are available.

Pros

- Free initial consultation and financial analysis

- High average client savings reported

- Transparent and ethical business practices

Cons

- No mention of National Tax Association accreditations

- Only serving Los Angeles, Orange, Riverside, San Bernardino, San Diego, Ventura County

“Jonathan really cares, and I now feel a lot better with him on my side. Hillhurst tax group will continue to work and resolve my IRS problem in 2016, I highly recommend the Hillhurst tax group, no need to go anywhere else.” Keith

Paramount Tax Relief – California

Paramount Tax Relief provides comprehensive tax solutions and a commitment to client success. They evaluate your tax situation and determine the best plan for your case with their professional tax team.

Services offered: Helps with tax debt, back taxes, removing liens, stopping wage garnishments and bank levies, audits, and tax preparation. Also offers support for payroll tax problems and IRS programs like Offer in Compromise.

Experience: Founded in 2014, with over 10 years of experience. Their team includes licensed tax professionals who work directly with the IRS and state tax agencies.

Customer satisfaction: Clients praise their professionalism and clear communication. Many reviews highlight their success in solving tax problems and securing good outcomes.

Pricing: Transparent pricing with no hidden fees. Offers free consultations and creates personalized plans based on each client’s needs.

Pros

- Free initial consultation

- Friendly and clear tax assistance

- Clear four-step process for tax resolution

Cons

- Specific focus on the Sacramento community

- Only serves in California and nearby areas

- No mention of National Tax Association accreditations

“Great service, they did a great job helping me with my issue with the IRS.” Erving F.

Victory Tax Lawyers – California

Victory Tax Lawyers is known for its expertise and commitment to client success. Therefore, this professionalism makes it a top choice. The company understands tax laws and achieves the best outcomes for its clients.

Services offered: Helps with tax debt relief, back tax filings, removing tax liens, stopping wage garnishments and bank levies, audits, and tax preparation. Also supports payroll tax issues and offers guidance on IRS programs like Offer in Compromise.

Experience: Founded in 2017, the firm’s tax attorneys each have at least 10 years of experience. They are licensed experts who work directly with the IRS and state tax agencies.

Customer satisfaction: Clients appreciate their professionalism and clear communication. Many reviews highlight their success in resolving tax problems and providing personalized service.

Pricing: Works on a flat-fee basis, depending on the case. Offers free consultations to review tax issues and create custom solutions.

Pros

- Free initial consultation

- Proven track record with significant savings for clients

- Comprehensive range of tax relief services

Cons

- Only serves in Downtown Los Angeles and nearby areas

- No mention of National Tax Association accreditation

“This firm is top-notch. Parham provided a roadmap for my corporate and personal tax questions that I wouldn’t have been able to figure out on my own. He is helpful, reliable, and supported by a team of brilliant professionals.” Michael Yadegaran

Semper Tax Relief

Semper Tax Relief is a reputable firm based in Orange, California, dedicated to resolving tax issues for individuals and businesses.

Services offered: Helps with IRS tax debt relief, unfiled tax returns, audit defense, IRS payment plans, penalty forgiveness, tax lien removal, and catch-up bookkeeping. Focuses on self-employed tax preparation and business tax debt solutions.

Experience: Started in 2014, led by Sergio Melendez, a U.S. Marine Corps veteran with a law degree and over 19 years of experience as an Enrolled Agent.

Customer satisfaction: Clients praise the firm for being professional, clear, and effective. Reviews highlight their personal approach and successful results.

Pricing: Has transparent pricing, but specific costs are not listed. Offers free consultations to review tax situations and create customized plans.

Pros:

- Free initial consultation

- Led by a licensed Enrolled Agent with over 19 years of experience

- Specializes in self-employed and business tax issues

Cons:

- Primarily serves in Los Angeles, Orange County, Orange County

- Limited information on pricing and accreditations

“Cindy and her team are lifesavers! My boyfriend was under immense stress after receiving multiple letters from the IRS, claiming he owed over $100,000. It felt overwhelming, and he didn’t know where to start. Cindy stepped in and went above and beyond to resolve the issue. Her professionalism, expertise, and dedication were evident throughout the entire process. She handled everything with precision and care, ensuring my boyfriend didn’t end up paying that massive amount. Thanks to Cindy and her incredible team, he can finally breathe again. We couldn’t be more grateful for her help and highly recommend her services to anyone in a similar situation!” Jennifer L.

Rush Tax Resolution

Rush Tax Resolution is a tax relief firm based in Los Angeles, California, dedicated to assisting clients with various tax-related issues.

Services offered: Helps with Offers in Compromise, wage garnishment release, unfiled tax returns, payment plans, state and payroll tax problems, tax liens, bank levies, penalty abatement, IRS audits, and tax preparation. Also assists with innocent spouse relief, tax planning, currently not collectible status, and sales tax audits.

Experience: Founded in 2014, the firm has a team of tax attorneys, CPAs, and Enrolled Agents with years of experience working directly with the IRS and state tax agencies.

Customer satisfaction: Clients praise the company for being professional, responsive, and effective. Reviews highlight their success in achieving favorable settlements and offering personalized service.

Pricing: Transparent pricing, though exact costs are not shared publicly. Offers free consultations to review tax situations and create custom solutions.

Pros:

- Free initial consultation

- Accredited by the Better Business Bureau (BBB) with an A+ rating

- Team of experienced tax attorneys, CPAs, and Enrolled Agents

Cons:

- Primarily serves clients in California

- Specific pricing details are not publicly disclosed

“EVERYONE at Rush Tax Resolution was friendly, courteous, and they acted extremely quickly to resolve my issues with the IRS. A BIG thank you to all who helped me.” Fred D.

Beware of tax relief scams

Many tax relief companies in the industry make empty promises to profit without genuinely assisting. Therefore, clients may find themselves in worse situations. The Federal Trade Commission called some “fraudsters” and didn’t accept their required IRS paperwork.

- Prioritize companies with positive client reviews.

- Have a clear communication about fees and services.

- Avoid those making guarantees without evaluating your case.

- Choose firms with certified tax professionals.

- For negative experiences, file Form 14157 to report potential fraud.

Feeling Overwhelmed?

It is best to decide on companies that have been serving for many years. Else, top rated tax relief companies often have a proven track record of success and transparent pricing. If you still can’t sit comfortably with a company in your own state, contact us. Precision Tax can provide services regarding tax relief and many other tax situations in every state in America.

Failing taxes on time can lead to serious financial consequences. The IRS charges extra fees for late payments or unfilled taxes. This puts you in a more difficult situation. How do you overcome it? Finding the best tax relief services California can help you have a stress-free process.

Research the companies in detail before choosing the right, trustable tax resolution companies, depending on your tax issues and budget.

Contact us for a free initial consultation and save hours.

Frequently Asked Questions

The IRS can charge penalties and interest. They may file a Substitute for Return (SFR) and start collection actions like wage garnishment or bank levies. Please check consequences of not filing.

The IRS can seize and sell your property, including your home, if you owe significant back taxes.

A tax levy is issued when you owe back taxes and haven’t arranged a payment plan. The IRS can take part of your wages directly from your employer.

The minimum payment depends on your financial situation. The IRS typically requires a reasonable monthly payment based on your income and expenses.

Yes, the IRS can seize your home if you owe a substantial amount in back taxes and don’t make arrangements to pay.

Check your IRS account online or request a tax transcript by mail.

The IRS can charge penalties, interest, and start collection actions against your business assets. Learn about how the IRS deals with payroll tax debts.

No, the IRS has a 10-year statute of limitations for collecting tax debts, starting from the date of assessment.

A tax levy is the legal seizure of property to satisfy a tax debt. To reverse it, pay the debt, set up a payment plan, or prove financial hardship.

A tax levy lasts until the tax debt is paid, a payment plan is arranged, or the levy is released by the IRS

Contact the IRS to set up a payment plan, apply for an Offer in Compromise, or request a temporary delay in collection.

The Fresh Start Program helps taxpayers settle their debts with easier payment plans, expanded installment agreements, and more flexible Offer in Compromise terms.