Whether you’re an individual or a business, navigating the complexities of tax laws can be stressful and overwhelming. This is where tax lawyers come into play. They simplify the whole process, providing clarity and stress-free, and work strategically to protect your finances. Besides, their expertise allows you to focus on your priorities.

In this article, we’ll review the best tax relief companies in Idaho, specifically in Coeur d’Alene, Pocatello, Boise, Meridian, and Nampa.

Tax relief companies in Idaho

Precision Tax Relief – Stateside

Since 1967, Precision Tax Relief has been helping individuals and businesses pay their IRS tax debts. The company is known for high customer satisfaction. Besides, unlike other company rules, customers don’t need to have a minimum debt amount. One of the best parts is that you can easily reach the company via phone, text message, e-mail, and live chat.

Pros

- Free initial consultation

- High customer satisfaction with a 98% rating

- Accredited by the American Society of Tax Problem Solvers (ASTPS)

- Offers a 30-day money-back guarantee

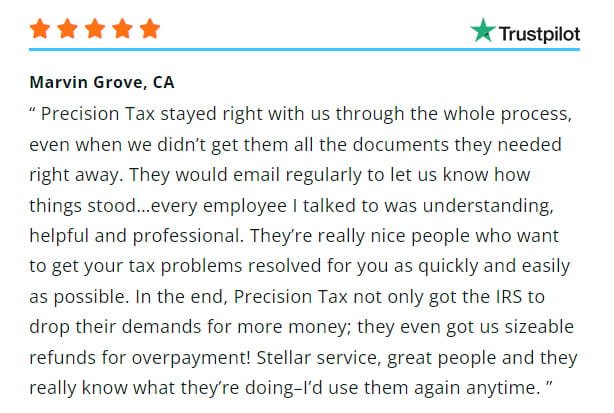

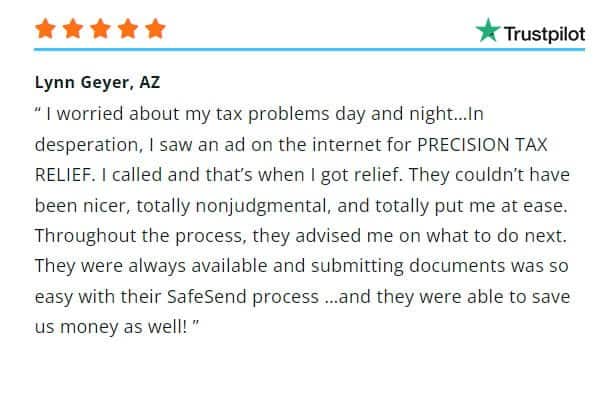

- One flat fee with flexible payment options

Precision Tax Relief is appreciated by clients for its expertise in handling high tax-related issues. It surpasses in maintaining transparent and regular communication, ensuring clients are well-informed throughout every phase. The clients experience alleviation from tax anxieties and also realize financial gains, with Precision Tax relief adeptly securing reductions and reimbursements for overpayments.

Idaho Tax & Bookkeeping Services

Idaho Tax & Bookkeeping Services specializes in various tax issues, ranging from personal and business tax services to audit and payroll assistance. Besides, the company offers a secure and state-of-the-art private office for consultations.

Pros

- Enrolled agent with the highest IRS credential

- Positive customer testimonials

Cons

- Limited to Idaho location

- No mention of national accreditations

“Excellent knowledge of existing tax laws, wonderful service and very professional. Ilir Nina at ITBS saved me a lot of money, times, and headache dealing with Idaho, California, and IRS. I’m extremely happy with the results. Highly recommended.” Rich McAllister

BERRETT TAX & FINANCE INC.

Berrett Tax & Finance company is a full-service accounting firm offering a blend of personal service and expertise to business owners, executives, and independent professionals. Besides, they’re licensed to operate in Idaho.

Pros

- Free initial consultation

- Provides personalized and expert services at affordable rates.

- Experienced and friendly team offering

- Offers a broad range of services for business owners, executives, and independent professionals.

Cons

- Serves only in Owyhee and nearby areas

- No mention of national tax association accreditations

“I’ve been going to Berrett Tax & Finance Inc. for 15+ years. Jason is extremely knowledgeable, highly professional, and is always looking out for his clients’ best interests. I would gladly recommend him to anyone who needed help with their taxes.” Bryan Vanshur

Feeling Overwhelmed?

Martelle & Associates, P.A.

Martelle Law Offices is well-known for resolving tax and debt issues. Also, the company is committed to assisting both individuals and businesses with back taxes help.

Pros

- Positive customer testimonials

- More than 25 years of experience in tax law

Cons

- Only serving in Boise, Idaho

- No mention free initial consultation

- No mention of national tax association accreditations

“My favorite thing about Martelle Law was that I could email about anything, and I would always get a prompt reply. They worked very hard for us, and had great communication.” Jessica G

Nevertheless, if you are complaining about not finding the best tax settlement services in Idaho, contact us. Precision Tax can provide services regarding tax relief and many other tax situations in every state in America. No worries, we offer a free initial consultation.

Frequently Asked Questions

The IRS can charge penalties and interest. They may file a Substitute for Return (SFR) and start collection actions like wage garnishment or bank levies. Please check consequences of not filing.

The IRS can seize and sell your property, including your home, if you owe significant back taxes.

A tax levy is issued when you owe back taxes and haven’t arranged a payment plan. The IRS can take part of your wages directly from your employer.

The minimum payment depends on your financial situation. The IRS typically requires a reasonable monthly payment based on your income and expenses.

Yes, the IRS can seize your home if you owe a substantial amount in back taxes and don’t make arrangements to pay.

Check your IRS account online or request a tax transcript by mail.

The IRS can charge penalties, interest, and start collection actions against your business assets. Learn about how the IRS deals with payroll tax debts.

No, the IRS has a 10-year statute of limitations for collecting tax debts, starting from the date of assessment.

A tax levy is the legal seizure of property to satisfy a tax debt. To reverse it, pay the debt, set up a payment plan, or prove financial hardship.

A tax levy lasts until the tax debt is paid, a payment plan is arranged, or the levy is released by the IRS

Contact the IRS to set up a payment plan, apply for an Offer in Compromise, or request a temporary delay in collection.

The Fresh Start Program helps taxpayers settle their debts with easier payment plans, expanded installment agreements, and more flexible Offer in Compromise terms.