Tax complexities can be daunting for many individuals and businesses. With the ever-evolving tax laws and the potential for errors, it’s crucial to have a reliable tax relief company by your side.

In this article, we’ll review the best tax relief companies in Michigan, specifically in Detroit, Warren, Grand Rapids, Southfield.

Tax relief companies in Michigan

Precision Tax Relief – Stateside

Since 1967, Precision Tax Relief has been helping individuals and businesses pay their IRS tax debts. This makes it one of the most reputable tax relief companies in the country. Whether you’re dealing with complex IRS settlements or need assistance with back taxes, their team ensures reliable and efficient solutions.

Services offered: Specializes in IRS tax settlements (Offers in Compromise), back tax returns, assistance with revenue officers, payroll tax problems, wage garnishments, bank levies, tax liens, IRS payment plans, penalty relief, and current year tax preparation.

Experience: Operating since 1967, with a team comprising IRS Enrolled Agents, CPAs, and an attorney, averaging 20 years of experience.

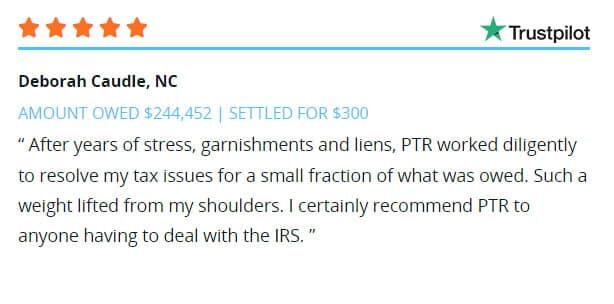

Customer satisfaction: Holds a 98% satisfaction rating across over 600 reviews, with clients praising their professionalism, transparency, and effectiveness in resolving tax issues. Precision Tax Relief is among the highest-rated tax relief companies in the nation.

Pricing: Utilizes a transparent, flat-fee structure with flexible payment plans and offers a 30-day money-back guarantee.

Pros

- Free initial consultation

- High customer satisfaction with a 98% rating

- Accredited by the American Society of Tax Problem Solvers (ASTPS)

- Offers a 30-day money-back guarantee

- One flat fee with flexible payment options

- It is suitable if you owe more than $10.000

Precision Tax Relief is a top choice for tax resolution, as evidenced by client testimonials. One client saw a debt of $244,452 settled for just $300. A single mother praised the team for turning her fears into a solution. Another was amazed when a $110,731 liability was settled for $100. These stories highlight the company’s effectiveness and commitment to their clients.

Levy and Associates — Michigan

Levy and Associates is a comprehensive tax resolution, audit defense, and accounting firm. They have been in the industry for decades, offering a range of services to address tax resolution and accounting needs.

Services offered: The firm provides comprehensive tax-related services, including audit defense, back tax assistance, wage garnishment relief, tax lien and levy resolution, offer in compromise, and tax return preparation.

Experience: With decades of experience, the team comprises CPAs, accountants, attorneys, enrolled agents, and former IRS revenue officers, bringing extensive knowledge and expertise to each case.

Customer satisfaction: Levy & Associates maintains an A+ rating with the Better Business Bureau, reflecting their commitment to resolving consumer concerns and providing quality service. It has a reputation as one of the best local tax relief companies.

Pricing: The firm offers free initial consultations to assess tax situations and provide customized solutions. They emphasize transparent fees and superior customer service.

Pros:

- Former IRS Offer in Compromise Specialist (OIC)

- Enrolled Agents

- Former IRS Appeals Officer

- Former IRS Revenue Officers

- Get a free tax review

Cons:

- Only serves in Florida, Michigan

“Greg, Lance, Stephanie and team are some of the most amazing people I’ve had the pleasure of working with! They are on point when it comes to helping our crew out with our IRS tax issues! They saved our company and the owner so much money already.” Erica Dell

Michigan Pure Tax Resolution — Michigan

Michigan Pure Tax Resolution is dedicated to offering top-notch customer service to Michigan taxpayers. They specialize in resolving IRS debt and other tax-related issues.

Services offered: The firm provides comprehensive tax-related services, including assistance with back taxes, audit representation, wage garnishment relief, tax penalty abatement, business tax help, and international tax compliance.

Experience: Founded in 2008 by Tim Halcomb, Michigan Pure Tax Resolution comprises licensed tax attorneys, enrolled agents, and tax accounting professionals with extensive experience in tax resolution and representation.

Customer satisfaction: Clients commend the firm for its professionalism, clear communication, and effective solutions.

Pricing: The firm offers free initial consultations to assess tax situations and provide customized solutions. They emphasize transparent fees and superior customer service.

Pros:

- Up-Front, Transparent Fees

- 24-Hour Availability for Clients

- Superior Customer Service

- Free Consultations

Cons:

- Only serves in Oakland, Wayne, Livingston, Washtenaw, Macomb, Monroe, Saint Clair

“I highly recommend this firm. Tim and his staff are professional, polite, and knowledgeable. They are always polite, helpful, and prompt. They helped me navigate a difficult situation and provide an invaluable service. Top-notch!” Eunice Hayes

Feeling Overwhelmed?

Lothamer — Michigan

With over 40 years in the business, Lothamer Tax Resolution is a trusted name in the tax industry. They focus on representing everyday people before the IRS and state authorities, providing relief from tax debt.

Services offered: The firm provides comprehensive tax-related services, including assistance with unfiled tax returns, bank levies, wage garnishments, unpayable tax debt, and IRS audits.

Experience: With over 40 years in the business, Lothamer Tax Resolution is a trusted name in the tax industry.

Customer satisfaction:

Clients commend the firm for its professionalism and effective solutions.

Pricing: The firm offers free initial consultations to assess tax situations and provide customized solutions. They emphasize transparent fees and superior customer service.

Pros:

- 360° tax resolution

- Interest-free financing

- Advanced digital tools

- 24/7 Access to case status

- 40+ years experience

Cons:

- Serves only in Southfield, Michigan

- No mention of free initial consultation

“I had not filed taxes for more than ten years, and Lothamer helped me with a tax payment plan that got my tax burden reduced. I would recommend anyone to get in touch with them. Most rewarding feeling.” Pierre C.

Good News Tax Relief — Michigan

As one of Michigan’s trusted companies that help with back taxes, Good News Tax Relief provides tailored support for individuals and businesses.

Services offered: The firm provides comprehensive tax-related services, including assistance with back taxes, unfiled tax returns, audit representation, and resolving issues related to liens, levies, and wage garnishments.

Experience: With over 22 years of experience, Good News Tax Relief’s team comprises tax attorneys, enrolled agents, and CPAs who negotiate with the IRS daily.

Customer satisfaction: Clients commend the firm for its professionalism and effectiveness in resolving complex tax issues. Good News Tax Relief holds an A+ rating from the Better Business Bureau (BBB).

Pricing: The firm offers a free, confidential, no-obligation consultation to assess tax situations and provide customized solutions. They emphasize transparent, flat-fee pricing with no hidden costs.

Pros:

- Experienced team with over two decades in tax resolution.

- Offers a comprehensive range of tax relief services.

- Positive client testimonials highlighting professionalism and effective solutions.

Cons:

- Primarily serves in Michigan

“Good News Tax Relief. LLC has been an amazing company to work with. We wanted to work with a local business, and Robert is patient, willing to help out in any way possible, and explains information in depth. We were leery when choosing a company because we heard so many horror stories, but the entire team at GNTR has proven to be honest, and they really care about helping people. They’ve taken the worry out of this process and have allowed us to breathe through a very stressful situation. Highly recommend it!” Susan Jones

Wolf Tax — Michigan

Wolf Tax focuses on solving tax problems efficiently. The firm provides tailored services for clients dealing with complex tax issues and ensures they regain control of their financial situation.

Services offered: The firm offers services such as audit defense, back taxes, installment agreements, offers in compromise, payroll taxes, and tax return preparation.

Experience: Led by tax attorney Evan Wolf, the firm has over a decade of experience in tax resolution and representation.

Customer satisfaction: Clients commend the firm for its professionalism and effective solutions.

Pricing: Wolf Tax offers free initial consultations to assess tax situations and provide customized solutions. They emphasize transparent fees and superior customer service.

Pros:

- Direct access to an experienced tax attorney.

- Strong focus on transparency and client education.

- Free initial consultations with no pressure.

Cons:

- Services are primarily available to Michigan residents.

- Limited details on pricing without consultation.

“I needed to file some back taxes but wanted them e-filed and was past the cut-off to do it myself. I called several tax pros, but Wolf Tax was the only one that was quick & responsive. They had my issue handled in less than 30 minutes, and now I’m free to move on from the looming tax “to do” issue! Very fair pricing and easy to pay online! I highly recommend using this firm!” Emily Jones

Tax challenges, while inevitable, don’t have to be insurmountable. With the right guidance and expertise, these hurdles can be navigated with ease. The tax relief companies listed above have proven their mettle in Michigan, offering residents a lifeline in their dealings with the IRS. If you find yourself grappling with tax-related issues, consider reaching out to these firms. Their expertise could be the difference between a tax headache and a smooth resolution.

Are you complaining about not finding the best tax settlement services in Michigan? No worries, just contact us. We represent both individuals and businesses nationwide as Precision Tax Relief. No matter your location, we can help you to get rid of the tax burden.

Frequently Asked Questions

The IRS can charge penalties and interest. They may file a Substitute for Return (SFR) and start collection actions like wage garnishment or bank levies. Please check consequences of not filing.

The IRS can seize and sell your property, including your home, if you owe significant back taxes.

A tax levy is issued when you owe back taxes and haven’t arranged a payment plan. The IRS can take part of your wages directly from your employer.

The minimum payment depends on your financial situation. The IRS typically requires a reasonable monthly payment based on your income and expenses.

Yes, the IRS can seize your home if you owe a substantial amount in back taxes and don’t make arrangements to pay.

Check your IRS account online or request a tax transcript by mail.

The IRS can charge penalties, interest, and start collection actions against your business assets. Learn about how the IRS deals with payroll tax debts.

No, the IRS has a 10-year statute of limitations for collecting tax debts, starting from the date of assessment.

A tax levy is the legal seizure of property to satisfy a tax debt. To reverse it, pay the debt, set up a payment plan, or prove financial hardship.

A tax levy lasts until the tax debt is paid, a payment plan is arranged, or the levy is released by the IRS

Contact the IRS to set up a payment plan, apply for an Offer in Compromise, or request a temporary delay in collection.

The Fresh Start Program helps taxpayers settle their debts with easier payment plans, expanded installment agreements, and more flexible Offer in Compromise terms.