Many US citizens find dealing with the IRS’s tax rules difficult because complicated tax laws and rates require careful attention. Otherwise, people may miss great opportunities.

If you want to maximize tax deductions, you need to understand tax law details. However, it may open up a can of worms for some taxpayers. This is where tax relief companies can ease your burden. They simplify these complex processes for you by providing guidance on navigating IRS tax rules.

In this article, we’ll review the best tax relief companies in Nevada, specifically in Las Vegas, Henderson, Sparks, Reno, Elko, Carson City.

Tax relief companies in Nevada

Precision Tax Relief — Stateside

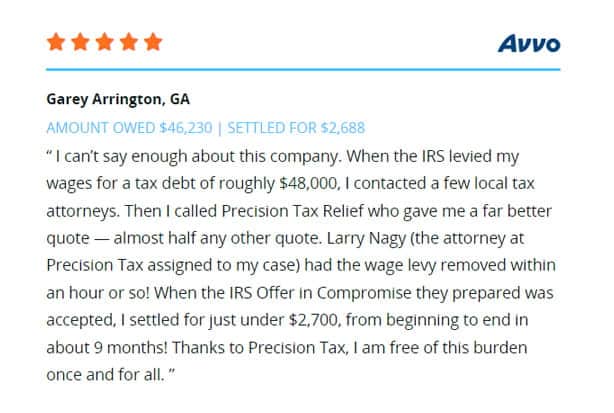

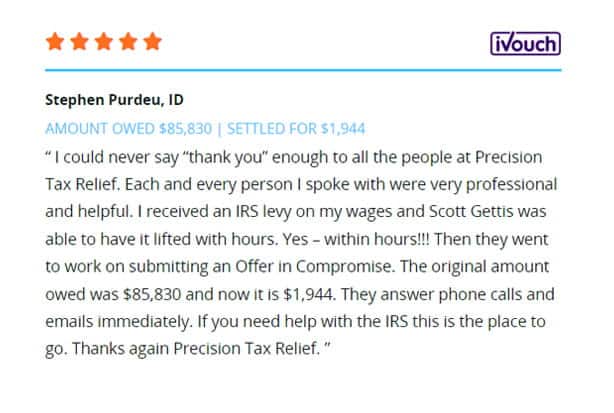

Since 1967, Precision Tax Relief has been helping individuals and businesses pay their IRS tax debts. The company is known for high customer satisfaction. Besides, unlike other company rules, customers don’t need to have a minimum debt amount. One of the best parts is that you can easily reach the company via phone, text message, e-mail, and live chat.

Pros

- Free initial consultation

- High customer satisfaction with a 98% rating

- Accredited by the American Society of Tax Problem Solvers (ASTPS)

- Offers a 30-day money-back guarantee

- One flat fee with flexible payment options

According to the good reviews from clients, Precision Tax Relief is a highly preferred company to deal with tax difficulties. First of all, clients consistently highlight the company’s unparalleled customer service, wherein the team patiently responds to inquiries and provides guidance throughout. The best, the company is really successful in reducing tax amounts significantly. Particularly in urgent circumstances such as the removal of IRS levies within hours. The combination of expertise, promptness, and genuine care for clients makes them a top choice for tax relief services.

Feeling Overwhelmed?

Targeted Tax Relief — Nevada

The firm specializes in helping individuals and small businesses navigate complex tax issues. The team’s aim is to transform overwhelming tax challenges into manageable solutions. Whether you’re dealing with unexpected tax debt or any IRS levies, they can provide an ethical and effective solution.

Pros:

- National Association of Enrolled Agents (NAEA) Member

- American Institute of Certified Tax Planners™ Member

- National Association of Tax Professionals (NATP) Member

- Certified Tax Coach

- National Tax Practice Institute™ Fellow

- Free initial consultation

- Identifies as women-owned.

Cons:

- Limited to tax relief services.

“I went through a very difficult time with the loss of my wife, and I was emotionally and financially drained. This led me to become delinquent on several years of tax filings and basically gave up, that is until I met Tracy. She took the lead and worked with me to file eight years of back taxes, and settled a 140K debt to 24K, and I got my life back on track. I can’t thank Tracy and her team enough for where I’m at today in my life.” JTM

Montti Income Tax Services — Nevada

It’s a family-owned tax company located in Las Vegas. The team enables you to reduce your taxes in a risk-free way and take control of your tax responsibilities.

Pros:

- More than 16 years experience.

- They also have accounting specialists

Cons:

- Specific focus on the Nevada region.

- No mention of free initial consultation

“Kristin and Maribel have filed our taxes and assist with bookkeeping for our business for the last two years. We’re very happy with the services they provide. Highly recommend their services, from taxes to strategy, these girls do it all.” Rosie Tamayo

Raben CPA Firm — Nevada

With personalized tax solutions, they solve any tax problems for individuals or business needs. Therefore, the company has a reputation for its professionalism and high-quality customer service.

Pros:

- Accredited tax professionals.

- More than 40 years experience.

Cons:

- Only serves the Las Vegas and Henderson area.

- No mention of free initial consultation.

“It was my first year of owning a business, and Marc made it very simple for me. He explained everything clearly, sent in all my information, and he did the rest. I was stressed for no reason, and he made it simple.” Zach Lugris

Are you complaining about not finding the best tax settlement services in Nevada? No worries, just contact us. Wherever you live in the US, we’re ready to help you. And, we offer a free initial consultation for all state taxpayers.

Frequently Asked Questions

The IRS can charge penalties and interest. They may file a Substitute for Return (SFR) and start collection actions like wage garnishment or bank levies. Please check consequences of not filing.

The IRS can seize and sell your property, including your home, if you owe significant back taxes.

A tax levy is issued when you owe back taxes and haven’t arranged a payment plan. The IRS can take part of your wages directly from your employer.

The minimum payment depends on your financial situation. The IRS typically requires a reasonable monthly payment based on your income and expenses.

Yes, the IRS can seize your home if you owe a substantial amount in back taxes and don’t make arrangements to pay.

Check your IRS account online or request a tax transcript by mail.

The IRS can charge penalties, interest, and start collection actions against your business assets. Learn about how the IRS deals with payroll tax debts.

No, the IRS has a 10-year statute of limitations for collecting tax debts, starting from the date of assessment.

A tax levy is the legal seizure of property to satisfy a tax debt. To reverse it, pay the debt, set up a payment plan, or prove financial hardship.

A tax levy lasts until the tax debt is paid, a payment plan is arranged, or the levy is released by the IRS

Contact the IRS to set up a payment plan, apply for an Offer in Compromise, or request a temporary delay in collection.

The Fresh Start Program helps taxpayers settle their debts with easier payment plans, expanded installment agreements, and more flexible Offer in Compromise terms.