Facing tax debt in New Jersey? Discover the best tax relief companies of 2024. These experts simplify IRS issues, negotiate settlements, and provide a path to financial freedom. Stop worrying about taxes and feel better now. These tax relief services help individuals and businesses.

In this article, we will review the best tax relief companies in New Jersey, specifically in West Milford, Vineland, Millville, Hammonton, Egg Harbor Township, Morganville, etc. If you are searching for tax resolution services near me in New Jersey, these firms offer reliable solutions.

Best Tax Relief Companies in New Jersey

Precision Tax Relief — Stateside

Since 1967, Precision Tax Relief has been helping individuals and businesses pay their IRS tax debts. The company is known for high customer satisfaction. Besides, unlike other company rules, customers don’t need to have a minimum debt amount. One of the best parts is that you can easily reach the company via phone, text message, e-mail, and live chat.

Services offered: Specializes in IRS tax settlements (Offers in Compromise), back tax returns, assistance with revenue officers, payroll tax problems, wage garnishments, bank levies, tax liens, IRS payment plans, penalty relief, and current year tax preparation.

Experience: Operating since 1967, with a team comprising IRS Enrolled Agents, CPAs, and an attorney, averaging 20 years of experience.

Customer satisfaction: Holds a 98% satisfaction rating across over 600 reviews, with clients praising their professionalism, transparency, and effectiveness in resolving tax issues. Precision Tax Relief is among the highest-rated tax relief companies in the nation.

Pricing: Utilizes a transparent, flat-fee structure with flexible payment plans and offers a 30-day money-back guarantee.

Pros:

- Free initial consultation

- High customer satisfaction with a 98% rating

- Accredited by the American Society of Tax Problem Solvers (ASTPS)

- 2023 BBB Torch Award for Ethics

- Offers a 30-day money-back guarantee

- One flat fee with flexible payment options

- It is suitable if you owe more than $10.000

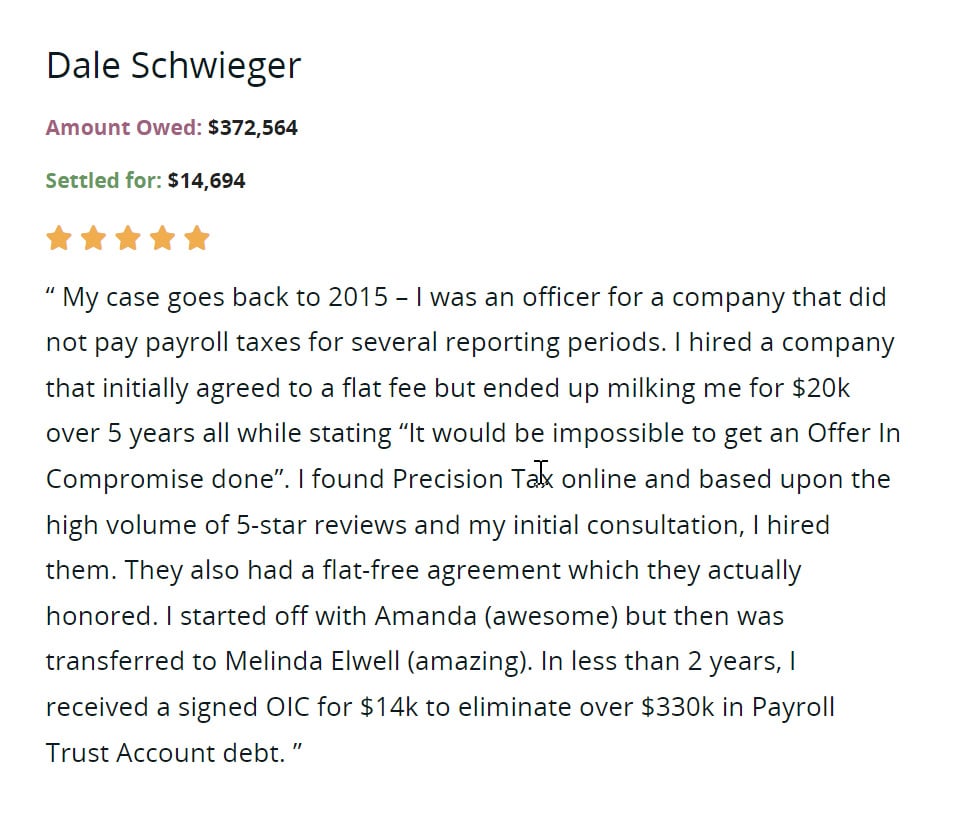

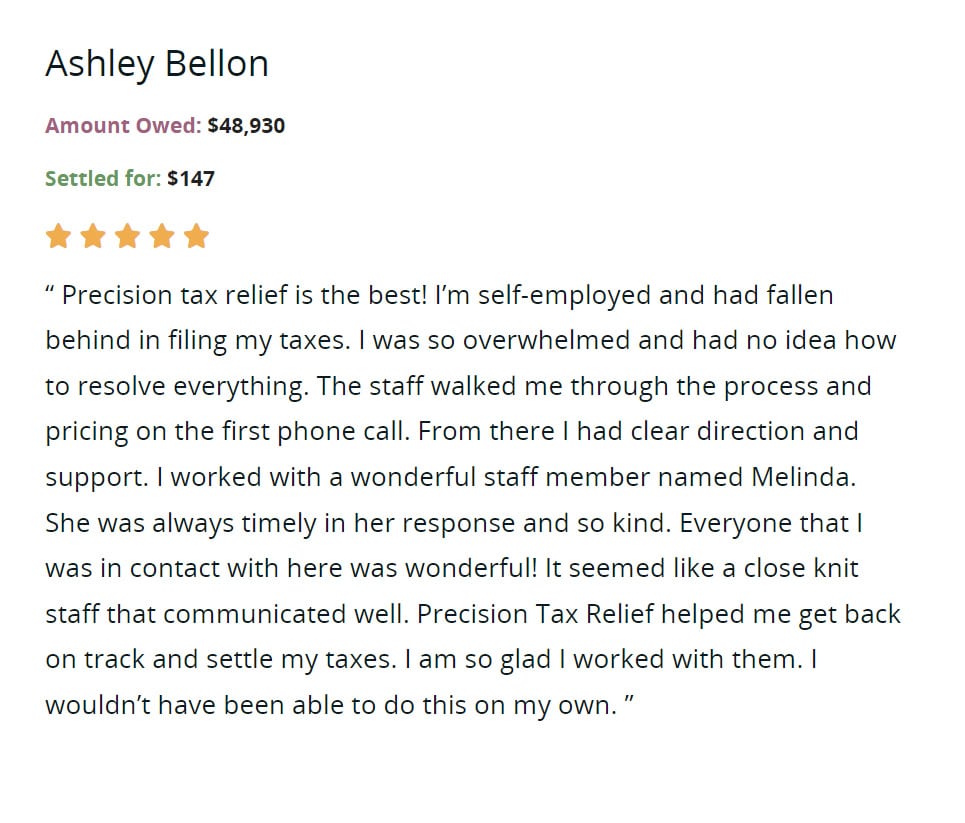

Precision Tax Relief Company stands out as the best tax relief service due to its remarkable client success stories. Clients highlight the firm’s ability to significantly reduce large tax debts to minimal amounts, showcasing their expertise in negotiating with the IRS. Their personalized approach demonstrates their commitment to each client’s unique situation. With consistent five-star ratings, clients praise Precision Tax for their professional, precise, and compassionate handling of complex tax issues, leading to substantial financial relief and peace of mind.

Feeling Overwhelmed?

BADRAN Tax & Accounting — New Jersey

Badran Tax & Accounting offers comprehensive tax services, including planning and preparation for both individuals and businesses. They also provide accounting, bookkeeping, payroll, and QuickBooks services.

Services offered: Helps with tax preparation and planning, IRS representation, bookkeeping, payroll services, audit representation, reducing IRS tax debt, and QuickBooks assistance.

Experience: Founded in 1985, the firm uses its experience and expertise to deliver personalized and professional service to every client.

Customer satisfaction: Clients praise the team for being professional, responsive, and effective. Reviews highlight their success in negotiating favorable outcomes and offering personalized attention.

Pricing: Offers transparent pricing, but specific costs are not shared publicly. Free consultations are available to review tax situations and create tailored solutions.

Pros:

- Extensive experience, with 38 years in the business.

- Offers a broad range of services.

Cons:

- Received a C+ rating from the Better Business Bureau.

- Not BBB accredited.

- No mention of free initial consultation.

- Only serves in New Brunswick, Edison, Somerset, and New York City.

“The Badran Tax & Accounting firm is top-notch. Excellent preparation & resolution services. Staff is highly responsive to all inquiries.” – Scott Carbone

Central Jersey Tax Services — New Jersey

Central Jersey is a tax, bookkeeping, and payroll company in New Jersey. And, they provide efficient, affordable tax services for businesses and individuals.

Services offered: Handles tax preparation and planning, bookkeeping, payroll services, and business consulting for individuals and businesses.

Experience: With over 20 years of experience, the firm provides expert and personalized service to clients in Howell, Jackson, Brick, Freehold, Toms River, Lakewood, and nearby towns.

Customer satisfaction: Clients praise the firm for its responsive service and professionalism. Reviews highlight their dedication to meeting client needs.

Pricing: Transparent pricing is offered, but exact fees are not shared publicly. Free consultations are available to review tax situations and create tailored solutions.

Pros:

- Specialize in business and individual taxes.

- Has experience over 20 years.

Cons:

- Not BBB accredited.

- Only serves in Monmouth/Ocean County areas.

- No mention of free initial consultation.

“Refreshing experience with finely balanced professionalism and comfort. Very personable staff that approached every interaction with patience and levity. Most importantly, I felt comfortable, looked after, and much less stressed. Couldn’t ask for more. Stand up Folks. Thanks a lot Barbara & Ed” – Fran Zeus

Tax Firm — New Jersey

Since 1990, it has been assisting individuals and self-employed workers in New Jersey with their tax returns. The company has a personalized approach to tax preparation to clients understand and take advantage of all tax benefits available to them.

Services offered: Handles tax preparation and planning, past due taxes, NJ inheritance taxes, amended tax returns, IRS representation, and tax relief services for individuals and small businesses.

Experience: Founded in 1998, the firm has over 20 years of experience. Their team includes CPAs and tax attorneys focused on providing personalized service.

Customer satisfaction: Clients praise the firm for its professionalism, responsiveness, and ability to solve complex tax issues. Reviews highlight their thorough and effective approach.

Pricing: Transparent pricing. Offers discounts for first responders and military families. Free consultations are available to review tax situations and provide tailored solutions.

Pros:

- Over 30 years of experience in tax services.

- Transparent pricing with no hidden fees.

- Remote filing online.

- Affordable prices all the time.

- Quick turnaround, with most refunds processed within two weeks.

Cons:

- No mention of free initial consultation.

- Requires payment at the time of appointment.

- Only serves in New Jersey

“Exceptional experience, quality work as well as professional caring people at Taxfirm. Would recommend to anyone. Over 20 years with them.” – Jim Sodaitis

Clean State Tax — New Jersey

Clean Slate Tax is a tax relief firm that assists individuals and businesses in resolving tax-related issues.

Services offered: Helps with tax levies, wage garnishments, bank levies, tax liens, unpaid taxes, tax penalties, unfiled taxes, back taxes, offers in compromise, state tax issues, penalty abatements, innocent spouse relief, currently not collectible status, tax debt settlement, and audit defense.

Experience: Founded in 2013, the firm has over 25 years of combined experience in solving IRS and state tax problems.

Customer satisfaction: Clients praise the firm for being professional, responsive, and effective. Reviews highlight their success in negotiating favorable settlements and providing personalized attention.

Pricing: Offers transparent pricing, but specific costs are not shared publicly. Free consultations are available to review tax situations and create custom solutions.

Pros:

- Free initial consultation

- 100% money-back guarantee

- Team of licensed tax professionals

Cons:

- Services may not be available in all states

- Specific pricing details are not publicly disclosed

“Clean Slate Tax saved me over $100,000! Not only that, they released a levy on my bank account. This company was worth every penny!” Josefina Mason

South Jersey Tax Services — New Jersey

South Jersey Tax Services is a tax and financial services firm based in Barrington, New Jersey, offering assistance to clients nationwide.

Services offered: Offers tax planning, tax debt resolution, tax preparation, e-filing, and tax relief strategies to help clients understand their rights as taxpayers.

Experience: Founded in 2010 and led by Matthew McDermott, a licensed CPA, the firm has a team of nationally licensed CPAs with over a decade of experience.

Customer satisfaction: Clients praise the firm for its professionalism, responsiveness, and effective tax solutions. Reviews highlight their personalized service and dedication to client success.

Pricing: Transparent pricing is offered, but specific costs are not publicly shared. Free consultations are available to review tax situations and create custom solutions.

Pros:

- Nationally licensed CPAs

- Free initial consultation

- Secure file transfer portal for sensitive documents

Cons:

- Specific pricing details are not publicly disclosed

- Primarily serves in New Jersey

“Great first experience. Very polite. Very fast but also very thorough. Had a rather complicated personal return, and they walked me through it. Would go again.” Tom S.

Are you complaining about not finding the best tax settlement services in New Jersey? No worries, just contact us. Precision Tax Relief is one of the leading tax resolution companies providing expert solutions in every state in America.

Frequently Asked Questions

The IRS can charge penalties and interest. They may file a Substitute for Return (SFR) and start collection actions like wage garnishment or bank levies. Please check consequences of not filing.

The IRS can seize and sell your property, including your home, if you owe significant back taxes.

A tax levy is issued when you owe back taxes and haven’t arranged a payment plan. The IRS can take part of your wages directly from your employer.

The minimum payment depends on your financial situation. The IRS typically requires a reasonable monthly payment based on your income and expenses.

Yes, the IRS can seize your home if you owe a substantial amount in back taxes and don’t make arrangements to pay.

Check your IRS account online or request a tax transcript by mail.

The IRS can charge penalties, interest, and start collection actions against your business assets. Learn about how the IRS deals with payroll tax debts.

No, the IRS has a 10-year statute of limitations for collecting tax debts, starting from the date of assessment.

A tax levy is the legal seizure of property to satisfy a tax debt. To reverse it, pay the debt, set up a payment plan, or prove financial hardship.

A tax levy lasts until the tax debt is paid, a payment plan is arranged, or the levy is released by the IRS

Contact the IRS to set up a payment plan, apply for an Offer in Compromise, or request a temporary delay in collection.

The Fresh Start Program helps taxpayers settle their debts with easier payment plans, expanded installment agreements, and more flexible Offer in Compromise terms.