Congratulations on starting your own business. As a new business owner, you have many responsibilities, including keeping track of your finances and paying your taxes. This article won’t hire you a bookkeeper, but it will provide a basic overview of how to pay taxes on self-employed income.

Why is this important?

In a nutshell: you have to pay taxes as you earn income.

If you don’t pay enough tax through estimated tax payments, you may be charged a penalty. You also may be charged a penalty if your estimated tax payments are late, even if you’re due a refund when you file your tax return.

What is Estimated Tax Payments (ETP)?

When you’re an employee, your employer withholds taxes from every paycheck and sends that money to the IRS on your behalf. Essentially, you’re paying your taxes as you go. Estimated tax payments allow individuals to pay not only their income tax, but other taxes such as self-employment tax and alternative minimum tax as their business generates income.

Who should file and pay quarterly taxes?

- Most freelancers

- Independent contractors

- Sole proprietors

- People who runs a business as their own

Note: You may still need to make estimated tax payments even if you are not self-employed.

Those who should pay quarterly estimated taxes are:

- Individuals, sole proprietors, partners, and S‑corporation shareholders must generally make quarterly estimated tax payments if they expect to owe $1,000 or more after withholding and credits, and if their withholding and credits are less than 90% of their current year tax or 100% (110% for high AGI) of their prior year’s tax liability.

- Farmers and fishermen with at least two‑thirds of their income from those activities typically need to make only one estimated tax payment, due January 15 (or the next business day) following the tax year. For example, for the 2025 tax year, that payment is due January 15, 2026. If they file their 2025 Form 1040 by March 2, 2026 and pay all taxes owed, they do not need to make the January estimated payment.

If you didn’t have any tax liability from last year, the prior tax year covered a 12-month period, you’re a US citizen for the year, and you don’t project any increases in net profits this year, then you don’t have to pay estimated tax payments for the current year.

Besides, if freelancing is your side hustle apart from your onsite job, you may be exempt yourself from paying quarterlies. Just, you should talk with your employer to withhold a little extra from your earnings. And, you can reduce your self-employment income by claiming the qualified business income (QBI) deduction. It cuts up to 20% on your tax return of your pass-through income from self-employment or a small business.

Safe Harbor for Underpaying Estimated Tax

The “Safe Harbor Rules” are designed to protect taxpayers from penalties associated with underpayment of estimated taxes. Essentially, even if you underpay your estimated taxes during the year, you can avoid a penalty if you meet one of the safe harbor provisions.

If you pay:

- At least 90% of your current year’s tax liability, or

- 100% of the previous year’s tax (110% if your adjusted gross income was over $150,000 or $75,000 for married filing separately),

you won’t face penalties. These rules are especially helpful for taxpayers with irregular incomes or unexpected earnings during the year.

What are Self-Employed Tax Obligations?

You should file an annual tax return, but typically pay estimated taxes every quarter. There are quarterly periods to prevent financial issues and penalties that may be encountered when the deadline comes.

Quarterly taxes generally include two categories:

- Paying self-employment (SE) tax (Social Security and Medicare)

- Paying income tax

What sources of income do you need to declare? Stock dividends, interest, capital gains, any income.

Feeling Overwhelmed?

How to Make Estimated Tax Payments for Self-Employed

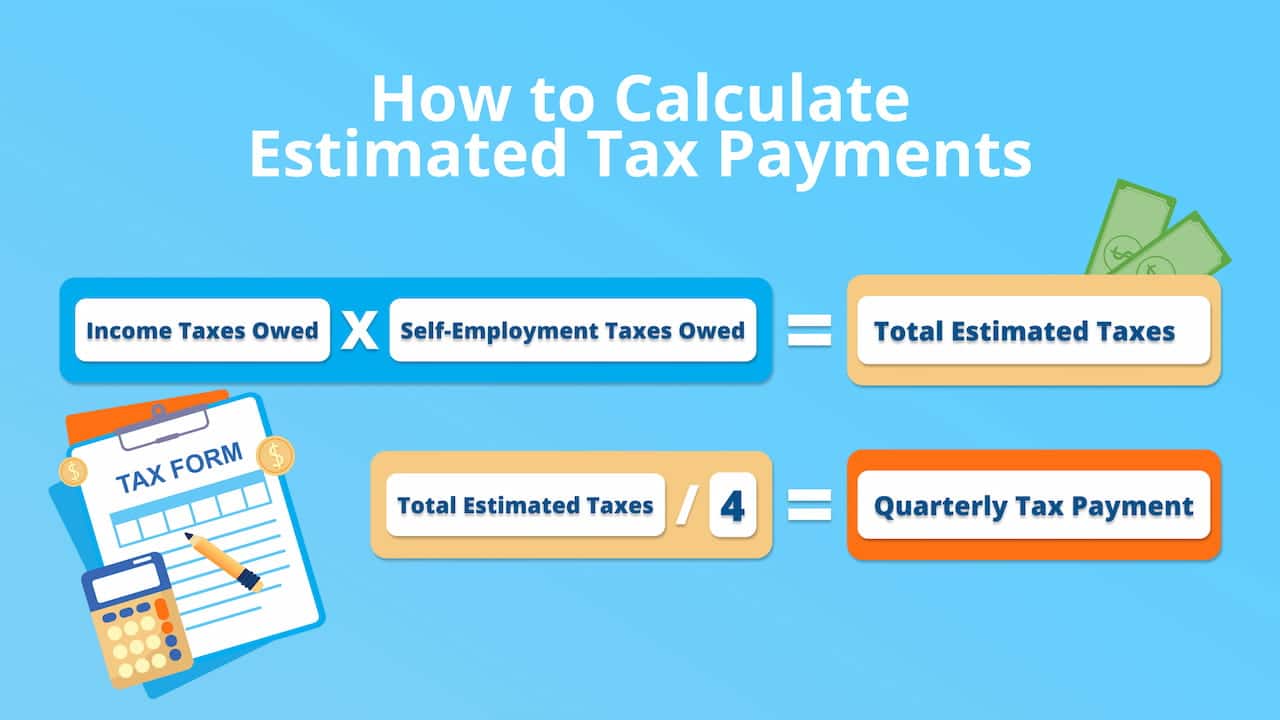

- First calculate your gross income, then subtract any deductions you’re eligible to find out your Adjusted Gross Income (AGI). If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of Form 1040 or 1040-SR. If your expenses are more than your income, the difference is a net loss.

- Then, calculate your income tax. Multiply your AGI by your tax rate. Attention, income tax bracket rate changes every year.

- Everyone who makes more than $400 per year must also pay self-employment taxes. Multiply your estimated total income by 92.35% to calculate your taxable income in relation to the self-employment tax. Then, multiply this result by 15.3% to find the amount you need to pay.

- Divide the annual months by four to calculate your quarterly payments.

Note: Set aside an amount for your estimated tax payments. It has become common practice for tax preparers to provide you with payment vouchers to mail in with your quarterly payments. If you don’t have payment vouchers, take either your estimate tax liability for this year or last year’s tax liability and divide it by four.

What is Form 1040?

Form 1040 provides self-employed individuals with information to estimate their taxes, including payment deadlines and deductions. It contains a worksheet for detailed tax calculations and outlines the procedure for determining taxes.

When are quarterly taxes due for 2026?

For the 2026 tax year, estimated tax payments are due on April 15, June 15, and September 15 of 2026, and January 15, 2027, for the fourth quarter. The IRS uses actual payment dates rather than simple calendar quarters, and if a date falls on a weekend or holiday, the deadline moves to the next business day.

If you don’t pay enough tax through withholding and quarterly payments, you may owe an underpayment penalty. The IRS figures this penalty based on how much you underpaid for each period and the applicable underpayment interest rate, which has been around 7% in recent quarters. It’s best to use IRS guidance or consult a tax professional to calculate exact rates and amounts.

How to pay quarterly taxes

By getting help from an accountant, you can simplify your tax processes and pay your debts on time. However, what are the payment methods? It can be made online, by phone, by app (IRS2GO) or by mail with an ETP voucher.

Besides, IRS Direct Pay is an online option for direct payments from your checking account without registration or paperwork. It takes about 15 minutes.

Alternatively, you can use the Electronic Federal Tax Payment System (EFTPS). This method requires a more extended registration process. After registering, the IRS will send you account information through regular mail, which can take approximately a week.

You always have the option of paying your quarterly taxes with a check or money order. Complete the payment voucher from Form 1040-ES. Then, mail it to the US Treasury Department.

Lastly, let say you can’t afford to pay the estimated tax amounts. In this situation, you can request an extension to your payment deadline or a new payment plan by negotiating with the IRS. For the best result, contact our tax attorneys. It’ll be easier to determine whether you’re eligible for any IRS payment plans.

Tips to be prepared

- Being prepared will always save you headaches and surprises later.

- First, figure out if you need to pay estimated tax payment.

- Refer to a prior year tax balance or ask a tax professional to help estimate your current year’s tax liability based on the business’s current numbers. You can also use the Form 1040-ES on the IRS website if you feel confident in estimating your own taxes.

- Last, but not least, adjust your payments year-to-year as your business changes, and enjoy one less thing to worry about.