Tax planning and preparation is like a puzzle where every piece is a bit of your financial information. If you put these pieces together correctly, you can file your taxes in a stress-free way.

Of course, this process isn’t only for big companies, it’s a must-do for everyone. What earnings should you report? What expenses can you deduct? And are you sure that you don’t overpay taxes? You should be able to answer these questions accurately.

Struggling with managing your financial life?

Stay ahead of your tax obligations and never miss a critical deadline again by downloading our Free 2025 Tax Calendar. Organize your tax year effortlessly! Keep reading to get your records in order and get ready for the 2025 tax season.

What is Tax Preparation?

Tax preparation is a financial audit in which you disclose your income to the authorities. Every year, individuals and businesses work on their tax returns to report income, expenses, and other relevant financial information.

Benefits of Tax Preparation:

- File accurately, in accordance with both state and federal regulations.

- Eliminate penalties by decreasing mistakes.

- Reduce tax liability by identifying eligible deductions and credits.

- Save time and say bye bye to stress by simplifying the complex tax filing process.

What is Tax Planning?

Tax planning is a financial roadmap throughout the year, not just a tax time, that guides you to save as much as possible on taxes. For the most profit result, you may want to work a pro – maybe a CPA or an Enrolled Agent. They help you make profitable money, like finding the best time to buy things for your business or deciding when to put more money into your retirement fund.

Benefits of Tax Planning:

- Minimize fiscal obligations by using various tax exemptions and deductions.

- Make smart financial decisions.

- Grow over time with effective long-term financial planning.

- Transfer your assets to your heirs in a more tax-efficient way.

- Improves investment returns by accounting for tax effects.

What is the Difference Between Tax Preparation and Planning?

Tax planning and tax preparation, while related, serve different purposes. Tax preparation spans the entire year, focusing on strategies to lessen your tax burden. This means using ways to save taxes on investments, planning your income to be tax-efficient, making charitable contributions to lower your taxes, and more. On the other hand, tax preparation is about accurately filing your tax return according to state and federal law. It’s a once-a-year activity. And, it doesn’t involve the proactive, ongoing strategies of tax planning.

Feeling Overwhelmed?

Step-By-Step Strategic Tax planning

Stay updated on tax law changes affecting income tax rates, deductions, and credits.

- Seek opportunities for deductions and credits in areas like retirement savings, education, and energy-efficient improvements.

- For business owners: Evaluate different structures (sole proprietorship, partnership, LLC, S corporation, C corporation) for tax efficiency.

- Update estate planning documents to reflect current financial goals.

- Consider investments with tax benefits, like retirement accounts and municipal bonds.

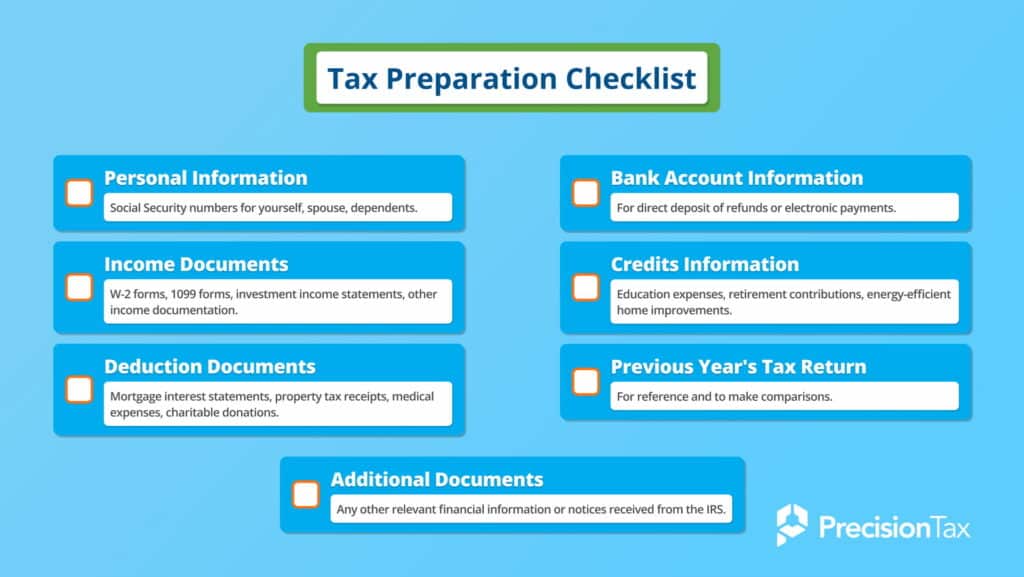

- Keep organized financial records and documents.

- Tax professionals can guide you through complex tax issues and ensure compliance.

Tax Return Preparer Credentials and Qualifications

All tax professionals with an IRS Preparer Tax Identification Number (PTIN) can prepare federal tax returns, but their skills, education, and expertise vary.

Unlimited Representation Rights

Agents, accountants, and lawyers can help with IRS problems, like audits and appeals.

- Enrolled Agents are licensed by the IRS and must take a comprehensive exam and complete 72 hours of continuing education every 3 years.

- Certified Public Accountants are licensed by the state and have to take a test called the Uniform CPA Examination. They also need to have certain education and experience.

- Attorneys are authorized by the state courts or bar associations, require a law degree and pass a bar exam, and must adhere to ongoing education and professional standards.

Limited Representation Rights

Preparers who don’t have these credentials can only represent the clients they helped, and only in limited situations with the IRS.

- Annual Filing Season Program Participants: Recognized by the IRS for continuing education efforts, they have limited practice rights for returns they prepared.

- PTIN Holders: Authorized to prepare returns but can’t represent clients before the IRS, except for returns filed before December 31, 2015.

How Many Tax Allowances Should I Claim?

How many tax allowances (withholding allowances) to claim depend on your finances. Besides, these allowances affect how much federal income tax is withheld from your paycheck. Several factors influence this decision, including your filing status, number of jobs, dependents, expected deductions, tax credits, and extra income sources.

Single individuals with one job might claim one or two allowances.

Married couples might claim one allowance each for themselves and their spouses.

You might claim one extra allowance for each dependent.

The W-4 form tells employers how much federal income tax to withhold from their pay. It provides details like the number of dependents, other income sources, and if they want extra tax withheld. Be careful while filling out the W-4. Otherwise, you may overpay taxes or face a tax bill due to under-withholding at tax time.

Provide more specific information about your tax situation. For the most accurate assessment, use the IRS Tax Withholding Estimator tool. Or consult with a tax professional, as everyone’s tax situation is different.

Do you need a tax calendar? You can view and download it here. If you are looking for a tax lawyer, benefit from our first free initial consultation. Contact us now.