When you owe a delinquent tax to the IRS (Internal Revenue Service), you will receive a notice or letter about seizing your property or property rights.

If they are IRS LT11 notice or Letter 1058, it is a serious matter.

This indicates that previous attempts to resolve the debt have been ignored or unresolved. At this point, you need to contact the IRS almost immediately.

However, how can you manage these results in the most financially and psychologically appropriate way? By understanding the language of these notices.

Keep reading.

What are LT11 Notice and Letter 1058?

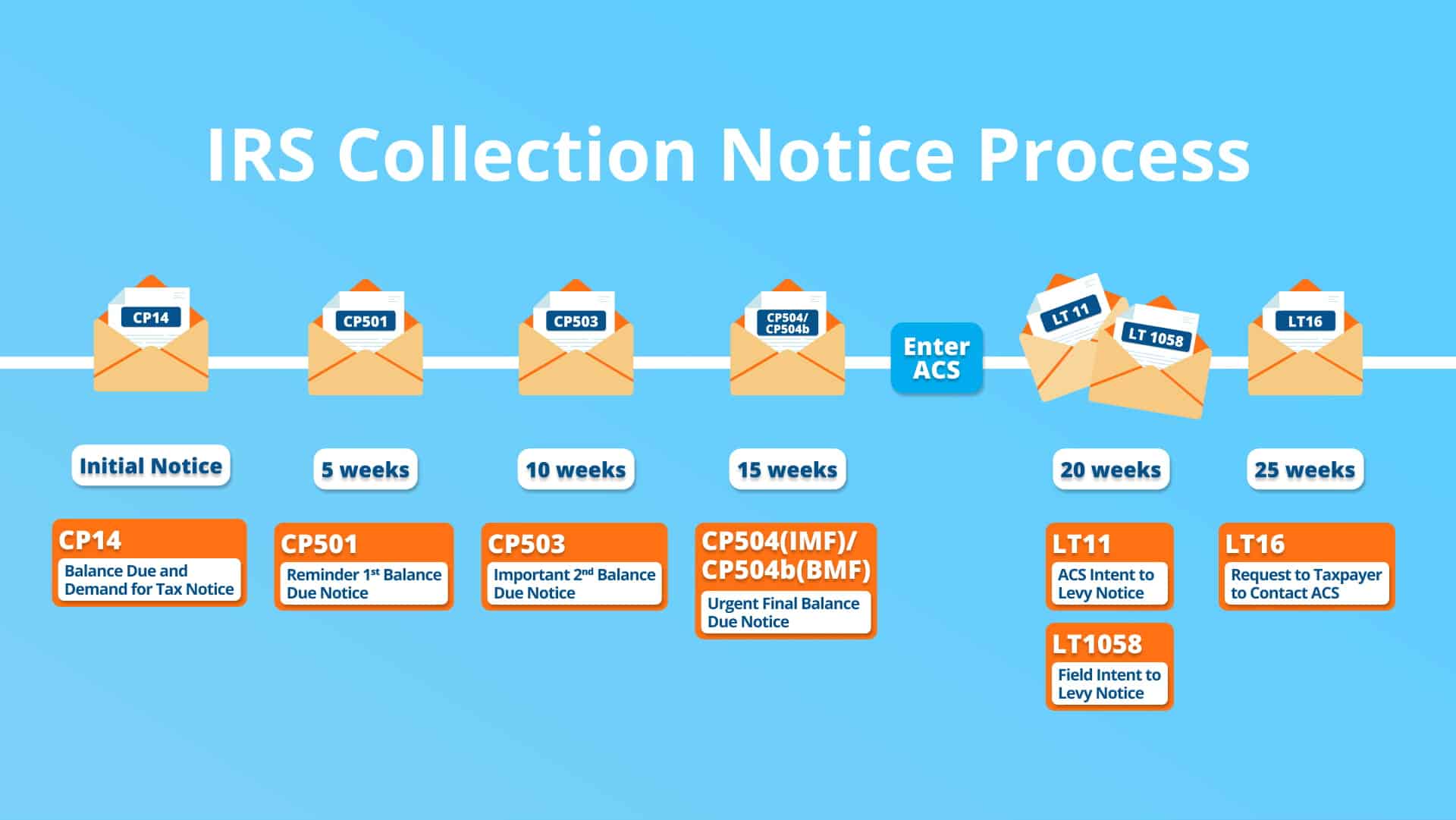

First, you will receive notices such as CP503, CP504, CP504B from the IRS. If you do not respond, the IRS will then send you LT11 and Letter 1058 notices, which means you are now at the point where your assets could be seized. These written notifications inform you that the IRS plans to seize your property or property rights if no action is taken, the IRS will take action. This phase is your last chance.

- CP501: First reminder of balance due

- CP502: Second request for payment

- CP503: Third reminder

- CP504: Intent to levy state tax refund or other property

What is the Difference Between LT11 and LT1058?

The LT1058 is usually sent by revenue officers, while the LT11 comes from the IRS’s Automated Collection Systems. Simply put, if a Revenue Officer is handling your case, you will likely get the LT1058 for asset levies. If not, the LT11 IRS is more probable. When your case is assigned to a revenue officer, you will typically receive IRS form 9297 to inform you.

Why Does the IRS Send Notices and Letters?

The LT11 Notice or Letter 1058 is the IRS’s final warning before they levy your property, and also notifies you of your right to request a court hearing. Besides, these legal documents explain what will happen if the taxpayer does not respond and what types of property can be taken. The IRS can place a levy on your wages or bank accounts up to the amount owed.

So who is the recipient of the IRS letter LT 1058 or LT11?

- You have unpaid tax debts on the due date.

- The IRS sent you multiple notices to remind you of your debt, but you ignore them.

- The IRS then sends IRS garnishment Letter 1058 or LT11 as final notice.

Now you have 30 days to take action from the date of the final notices.

What Happens If You Do Not Pay or Miss the Deadline of LT11 or LT 1058?

If you don’t respond within 30 days, the IRS subject to levies or seizures of your wages, other income, bank accounts, personal assets, state and federal tax refunds, social security benefits.

Moreover, you will not be able to get a new passport and your current passport will be revoked, if the IRS notifies the State Department about your situation.

Feeling Overwhelmed?

Allowable living expenses:

- National standards (food, clothing)

- National standards (out of pocket health care)

- Local standards (transportation)

- Local standards (housing)

If you are willing to pay but cannot pay your tax liability, what can you do? You should contact the IRS to discuss your financial situation and find a suitable arrangement. Besides, you have some options on how to stop a tax levy:

- Installment Agreement

- Partial payment installment agreement

- Offer in Compromise

- Currently Non-Collectable

However, to find the best financial option, you may need to get a consultation from a tax lawyer, because the whole process and tax laws can be complicated for non-lawyers.

How to Prevent LT11 Notice or Letter 1058

Ignoring these legal notices can result in wage garnishment, bank account levies, or even the seizure of other assets. If possible, it’s best to avoid getting an LT11 Notice or Letter 1058.

- Ensure to pay your taxes on time and respond to any initial IRS correspondence.

- If you have already received one, contact a tax professional immediately. Need one urgently? Contact us for a free initial consultation.

Already received? What should you do?

- Pay your unpaid balance to stop more interest and penalties. If you cannot pay the full amount, pay what you can. At least, it will reduce the amount of interest and penalties.

- If you are unable to pay, contact the IRS, all numbers listed on the notice or letter. Then, work out an arrangement with them to avoid liens, levies, or seizures.

- If you believe something is incorrect about the amount owed or else, you can file an appeal by requesting a Collection Due Process Hearing. However, you should respond within 30 days from the date of the notice. To make this process the easiest, it may be wise to collaborate with a tax attorney.

I.R.C. § 6331

I.R.C. § 6331 is a section in the US federal tax laws that outlines the IRS’s authority in the tax collection process. This means the IRS can legally seize your assets if you neglect or refuse to pay what you owe.

Need a professional help for LT11 or LT1058 ?

If dealing with tax laws feels overwhelming, we got you. Our tax professionals here to help you. Let’s navigate your situation and possibly setting up a payment plan.

Sooner rather than later, contact us.

Frequently Asked Questions

The LT11: Notice of Intent to Levy and Your Collection Due Process Right to a Hearing. Check here to see an example o notice LT11.

The IRS Letter 1058: Final Notice-Notice of Intent to Levy and Notice of Your Rights to a Hearing.

You should contact the IRS about your situation within 30 days. Otherwise, the IRS will start to collect your tax debt by seizing your assets.

You have 30 days to take action.

The IRS can levy your bank account as many times as necessary to collect the full amount owed. There is no set limit.

Property can include wages and other income, bank accounts, business assets, personal assets (including your car and home) and Social Security benefits.