According to the latest TIGTA report, the Inflation Reduction Act (IRA) has funneled significant resources into the Internal Revenue Service (IRS) to strengthen its operations and enforcement efforts.

Recently, the Treasury Inspector General for Tax Administration (TIGTA) report shed light on how these funds are being allocated and used. These details are essential for taxpayers who may be impacted by the growing emphasis on enforcement.

Background: IRS Funding Through the Inflation Reduction Act

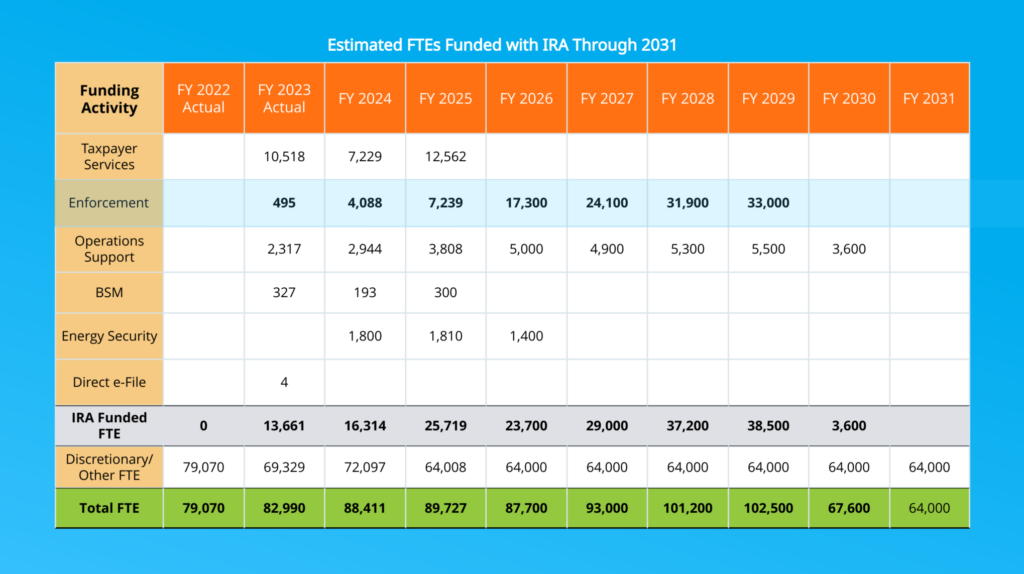

In total, the Inflation Reduction Act allocated $7.2 billion to the IRS, with a large portion of these funds specifically earmarked for enforcement purposes. Initially, the IRS set aside $1.48 billion for enforcement activities planned for 2024. However, despite these resources, only 3.4% of the total allocation had been spent as of last year, leaving much of the enforcement funding unused.

This slow ramp-up has prompted questions about how and when the IRS will fully deploy these resources to enhance tax compliance.

Challenges and Reallocation of Funds

While the initial allocation plan was clear, the IRS has faced evolving challenges that prompted a shift in its spending priorities. Instead of focusing solely on enforcement, the IRS has had to address a variety of budget shortfalls and operational inefficiencies. One key focus has been modernizing outdated technology systems, improving taxpayers outreach, and resolving issues such as long wait times for reaching IRS support via phone. These adjustments have delayed enforcement efforts but are viewed as necessary for building a more resilient and efficient IRS in the long term.

The Shift Towards Enforcement

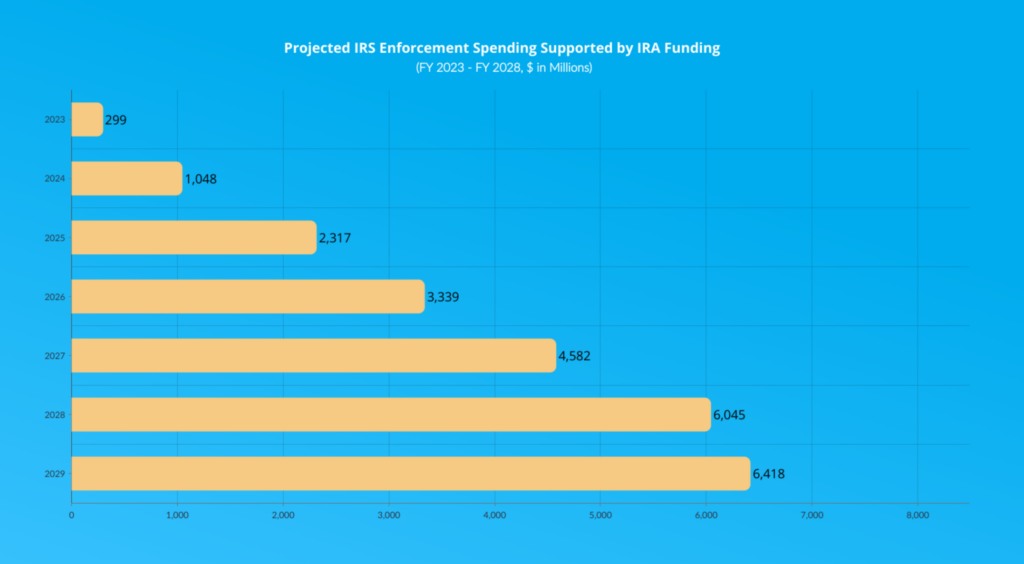

Despite these initial delays, the IRS is now accelerating its enforcement activities. Last year, the agency spent $299 million on enforcement initiatives, a figure that is expected to increase significantly to $1 billion this year. Looking ahead, the IRS plans to ramp up enforcement spending steadily through 2029, with much of the focus on targeting non-compliant taxpayers, conducting more thorough audits.

However, there are potential roadblocks that could hinder the IRS’s enforcement goals. One such roadblock is Congress has yet to approve additional funds beyond a certain point. To address this, the IRS has requested $104 billion in its 2025 budget proposal, which it hopes will carry enforcement efforts through 2031. The IRS projects that these enforcement activities could yield as much as $341 billion in additional revenue, but that depends heavily on securing continued funding.

How does technology modernization effect enforcement process?

Modernized systems will allow the agency to conduct audits and collections more efficiently by enabling the IRS to process a larger volume of cases with greater accuracy. By upgrading the IRS’s technology infrastructure, the IRS is setting the stage for a more aggressive enforcement strategy, which will include better tracking of tax evasion and quicker resolution of non-compliance issues.

As enforcement spending increases, so too will the IRS’s capacity to pursue non-compliant taxpayers. This will likely lead to more frequent audits, collections, and an enhanced focus on individuals and business that fail to file tax returns. Additionally, the IRS is expected to expand its asset seizure operations, particularly in cases where assets are being transported or hidden to avoid tax obligations.

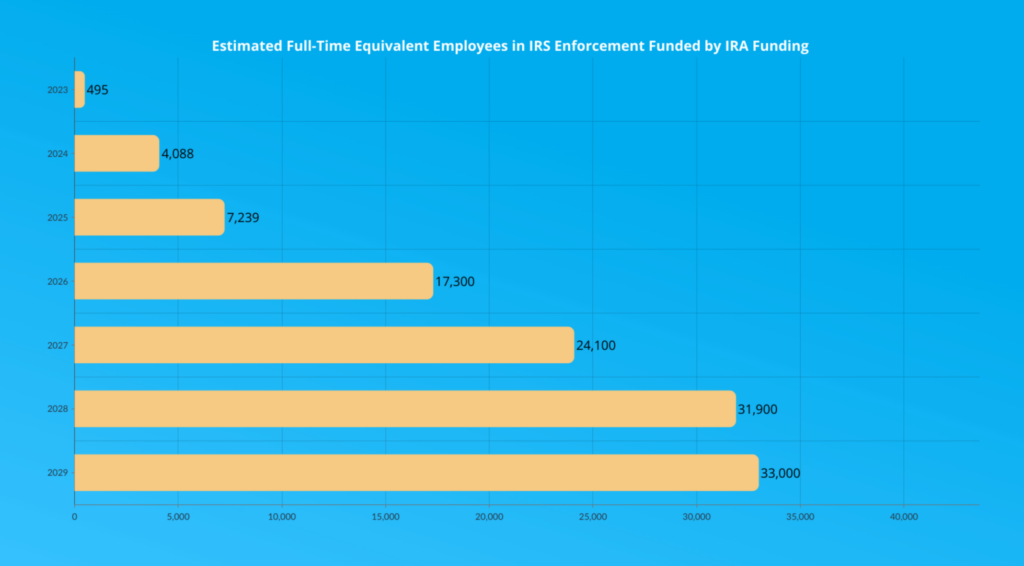

To meet its enforcement goals, the IRS is expanding its workforce. Last year alone, the agency hired 4,088 new employees, and it plans to bring on over 30,000 additional staff members by 2029. This workforce expansion is critical, as a significant portion of the current IRS workforce is nearing retirement. In fact, 18% of employees are eligible for retirement, with 37% expected to become eligible within the next five years. As new employees are trained and brought up to speed, the IRS will be better positioned to meet its enforcement objectives.

What Should Taxpayers Expect? Will There Be a Surge in IRS Audits?

Most notably, audits and collections are likely to become more common, especially for those who are non-compliant with their tax obligations. Additionally, the introduction of a new free e-file system could cause an uptick in incorrect tax returns, further increasing the likelihood of audits.

The IRS’s enforcement efforts are being significantly bolstered by new funding, workforce expansion, and technology modernization. While these changes are expected to increase compliance and revenue collection, they also mean that taxpayers need to be more vigilant than ever. As the IRS ramps up its enforcement activities, understanding these shifts and preparing for the impact will be essential for maintaining compliance and avoiding potential penalties.

If everything seems too complicated, contact us. We’ll help provide a roadmap for tax issues.